Sea Cliff, Bayville won’t exceed tax cap

Originally published: January 10, 2012 10:15 PM

Updated: January 10, 2012 10:25 PM

By BILL BLEYER bill.bleyer@newsday.com

Village boards in Sea Cliff and Bayville deferred giving themselves authority to exceed the state’s 2 percent cap on tax levy increases in next year’s budgets after boisterous residents opposed the action Monday night.

About 100 residents packed the Sea Cliff Village Hall meeting room for a hearing so heated at times that Mayor Bruce Kennedy broke his gavel trying to maintain order.

More than half of the 302 villages in the state have passed exemption laws with little fuss, Peter Baynes, executive director of the New York State Conference of Mayors, said. In Massapequa Park Monday night, the board authorized exceeding the new tax cap with no residents voicing concern.

But with overflow audiences mostly opposed to the proposals, the Sea Cliff board reserved its decision pending more information from the state, while Bayville trustees withdrew the proposal when residents called it premature.

Sea Cliff trustees decided to postpone a vote after Kennedy pointed out the board had 62 days to act and would wait until the last minute to make a decision. Kennedy pledged that there would be no large tax increase, saying his goal was no tax increase at all.

“What the governor and State Legislature did not consider when passing this tax cap is that . . . there are a multitude of expenses and state mandates that local governments must budget for but cannot control the costs of,” Kennedy told the crowd.

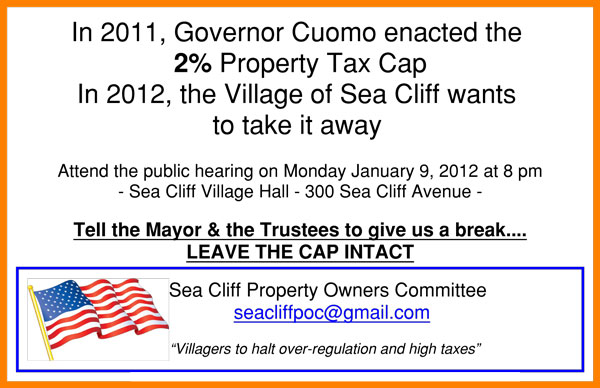

The large turnout was driven by a community group, Sea Cliff Property Owners Committee, recently formed by 20-year resident Anthony Losquadro, who mailed postcards to every resident urging them to attend and fight to keep the cap.

“Even though we have not been presented with any looming fiscal crisis, they [trustees] want to immediately jettison our tax cap protections,” Losquadro said.

Resident Nancy Rose said the board had been responsible about holding down spending and taxes and favored giving the mayor and trustees flexibility to exceed the cap if necessary.

“You have nothing to lose,” she said.

But Jerry Romano said, “The village needs to live within its budget, just like the rest of us do.”

And Brian Griffin said, “There are a lot of residents who would be willing to accept service cuts” rather than pay higher taxes.

In Bayville, Mayor Doug Watson told a standing-room crowd of 65 residents that the village faced a $25,000 increase in its payroll and a $55,000 increase in pension costs, which would represent all but $11,000 of a 2 percent increase in the tax levy.

Baynes said he was not aware of any major opposition in the 158 villages that already passed the override provision. “Because it’s the first year of the cap and the administration of the process is not 100 percent clear, municipalities don’t want to be caught inadvertently exceeding the cap,” he said.

In Massapequa Park, while the board passed the law, Mayor James Altadonna Jr. said he did not plan to exceed the 2 percent limit.

The Thomaston board Monday night unanimously approved a budget with a 2.4 percent increase in spending to $1.9 million, but a tax levy increase of only 0.24 percent.

With Emily Ngo

and Emi Endo

Like this:

Like Loading...